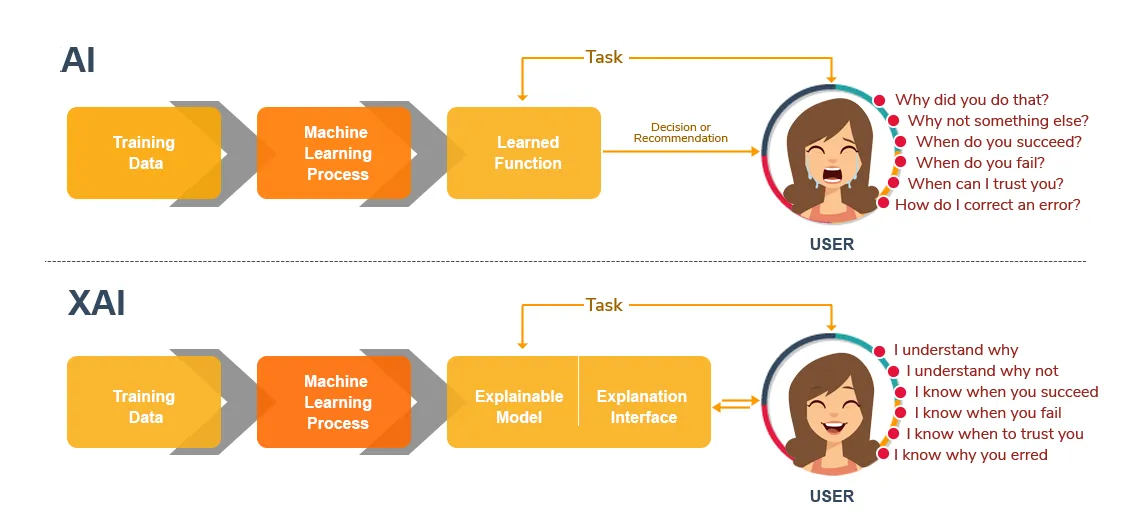

What exactly is Explainable AI?

Explainable AI (XAI) is a subfield of Artificial intelligence (AI) that focuses on developing algorithms and methods that can provide insight into how and why AI models make decisions. The goal of XAI is to make AI models more transparent and interpretable so that the decision-making processes of the models can be understood and trusted by humans.

Explainable AI (XAI) has been a growing area of interest in the field of Artificial intelligence (AI) in recent years. The increasing use of AI in decision-making processes across various industries, such as healthcare, finance, and transportation, has highlighted the need for transparency and interpretability in AI models.

Techniques used in XAI

Some of the main techniques used in XAI include:

Feature importance: This method provides insight into which input features are most important for the model's decision.

Local interpretability: This method provides insight into how the model is making decisions for specific input instances.

Counterfactual analysis: This method provides insight into how the model would have made a different decision if one or more input features had been different.

Searching for a reliable custom web development company ?

Model distillation: This method involves training a simpler model to mimic the behavior of a more complex model.

Model visualization: This method involves visualizing the internal workings of a model, such as the weights or activations of a neural network.

XAI aims to provide transparency and interpretability in the decision-making process of AI models so that the models can be trusted and understood by humans.

What is the need for Explainable AI?

One of the key drivers of the introduction of Explainable AI in the market is the increasing use of complex and opaque AI models, such as deep learning neural networks, which can be difficult for humans to understand and trust. This has led to concerns about the potential for bias and errors in AI decision-making, and a growing need for transparency and interpretability in AI models.

Another key driver of the introduction of Explainable AI in the market is the growing need for compliance with regulations and laws related to data privacy and security. Many regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), require organizations to provide transparency and control over the use of personal data. Explainable AI can help organizations comply with these regulations by providing insight into how AI models use personal data.

Explainable AI importance

The introduction of Explainable AI in the market is also driven by the needs of various industries and organizations to understand and trust the decision-making processes of AI models. This can be seen in various industries like healthcare, finance, transportation, and more.

The rising demand for transparency and interpretability in AI models, the requirement to comply with data privacy and security standards, as well as the necessity for diverse sectors to comprehend and trust the decision-making processes of AI models, have all contributed to the importance of XAI.

Role of Explainable AI in improving Custom Banking Software

Yes, explainable AI (XAI) can be used in banking software development. XAI is a type of artificial intelligence that allows for the interpretation and understanding of the decisions made by a machine learning model. This can be particularly useful in the banking industry where transparency and accountability are critical.

For example, XAI can be used to explain the reasoning behind a loan application decision, such as why an applicant was denied or approved. This can help the applicant understand the factors that were considered and potentially improve their chances of being approved in the future. Additionally, XAI can explain fraud detection decisions, helping banks better understand and prevent fraudulent activity.

Another example, XAI can be used in the field of credit scoring, which is the process of assessing a borrower's creditworthiness. Banks and financial institutions use credit scoring to determine whether to approve a loan application and on what terms. XAI can be used to explain the factors that were used to calculate a borrower's credit score and how they were weighted. This can help borrowers understand the reasons why their credit score is high or low and how they can improve it.

Thus, XAI can be used in a variety of ways in Financial software development to improve transparency, accountability, and trust in the decision-making process.

How Explainable AI is Changing the Banking and Finance Industry?

Explainable AI (XAI) can be very helpful in the banking sector in a number of ways. Here are some examples of how XAI can be applied in specific areas of banking:

#1 Risk Management

XAI can help banks to better understand the factors that contribute to risk and make more informed decisions about lending, investment, and other activities. For example, XAI can be used to identify patterns in loan application data that indicate a higher likelihood of default, such as a low credit score or a high debt-to-income ratio. By providing transparency and interpretability in the decision-making processes of AI models, XAI can help banks to identify and mitigate potential risks.

#2 Compliance

XAI can help banks to identify and prevent potential compliance violations by providing transparency and interpretability in the decision-making processes of AI models. For example, XAI can be used to identify patterns in transaction data that indicate money laundering or other illegal activities. By providing insight into the factors that contribute to a decision, XAI can help banks to identify and prevent potential compliance violations.

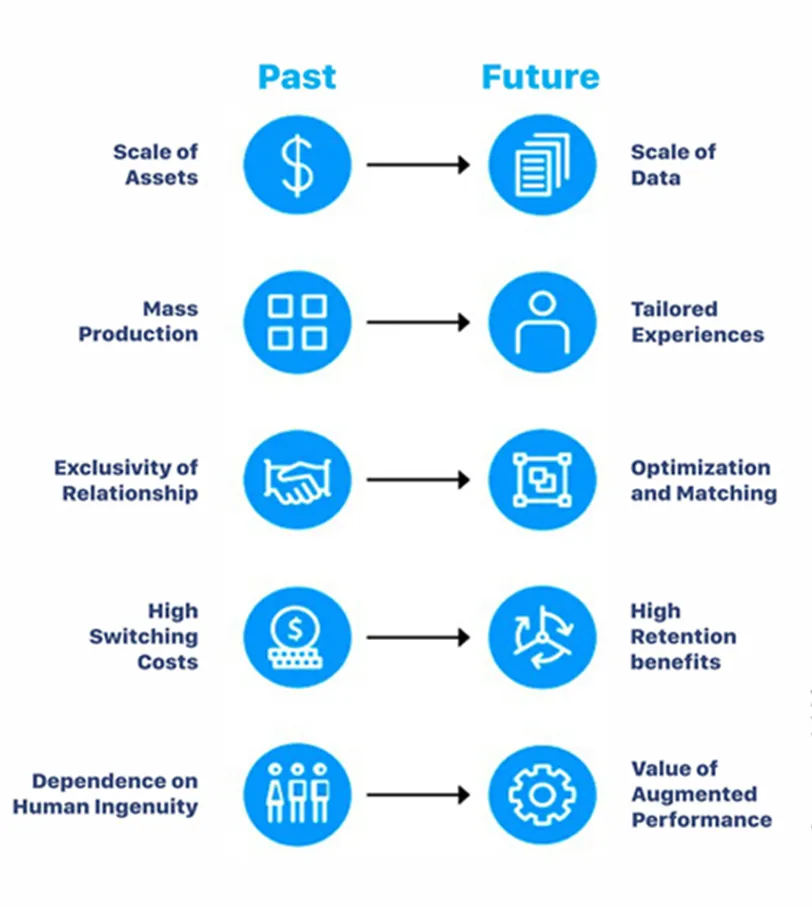

The diagram below compares conventional and modern banking procedures to help you understand how XAI is transforming the banking business.

Modern banking processes

#3 Personalized Marketing

XAI can be used to personalize marketing campaigns and offer relevant products to customers. For example, XAI can be used to analyze customer data and identify patterns that indicate a high likelihood of purchasing a specific product, such as a mortgage or a credit card. By providing transparency and interpretability into the decision-making processes of AI models, XAI can help banks to personalize marketing campaigns and offer relevant products to customers.

#4 Fraud Detection

XAI can help banks to detect and prevent fraudulent activity by providing insight into the factors that contribute to a decision and identifying patterns and anomalies that may indicate fraud. For example, XAI can be used to identify patterns in transaction data that indicate suspicious activity, such as large cash withdrawals or multiple transactions from different locations. By providing transparency and interpretability in the decision-making processes of AI models, XAI can help banks to identify and prevent fraud.

Looking to hire dedicated .NET developers for your business?

#5 Customer Service

XAI can be used to improve customer service by providing more accurate and personalized recommendations and by automating repetitive tasks. For example, XAI can be used to analyze customer data and provide personalized recommendations for financial products and services. Additionally, XAI can be used to automate repetitive tasks such as account opening, account closing, and account management.

These are the ways XAI can help banks to make more informed decisions, improve operational efficiency, and enhance the customer experience. By providing transparency and interpretability into the decision-making processes of AI models, XAI can help banks to identify and mitigate potential risks, prevent compliance violations, detect fraud, improve customer service, and personalize marketing campaigns.

Read More: .NET vs Java: Who will dominate in 2023?

How Explainable AI can be used in custom software development?

Explainable AI (XAI) can be used in custom software development to provide transparency and interpretability in the decision-making processes of AI models, which can help to improve the overall quality of the software.

Quality assurance

XAI can be used to test the performance and accuracy of AI models, and provide insight into how to improve the models. For example, XAI can be used to evaluate the performance of a model on a validation dataset and identify areas where the model is underperforming. Additionally, XAI can be used to provide insight into how the model is making decisions, which can help developers to identify and fix issues such as overfitting or bias.

Debugging

XAI can be used to identify and diagnose issues with AI models. For example, XAI can be used to analyze the decision-making process of a model and identify patterns or anomalies that indicate an issue with the model. Additionally, XAI can be used to provide insight into how the model is making decisions, which can help developers to understand and diagnose issues such as overfitting or bias.

Model selection

XAI can be used to compare different AI models and select the best one for a given task. For example, XAI can be used to evaluate the performance of different models on a validation dataset, and provide insight into how the models are making decisions. Additionally, XAI can be used to compare the interpretability and transparency of different models, which can help to select the best model for a given task.

Want to build custom Office 365 Add-ins for your Financial business?

Model interpretability

XAI can be used to provide transparency and interpretability in the decision-making process of AI models, so that the models can be understood and trusted by humans. For example, XAI can be used to provide insight into how the model is making decisions by visualizing the internal workings of the model, such as the weights or activations of a neural network. Additionally, XAI can be used to provide feature importance and local interpretability, which can help to understand the model's decision.

Model Optimization

XAI can be used to optimize the performance of AI models by identifying and addressing issues such as overfitting or bias. For example, XAI can be used to evaluate the performance of a model on a validation dataset and identify areas where the model is underperforming. Additionally, XAI can be used to provide insight into how the model is making decisions, which can help developers to optimize the model by addressing issues such as overfitting or bias.

Conclusion

In summary, XAI can be useful in custom software development to improve the performance, accuracy, and trustworthiness of AI models. By providing insight into how and why AI models make decisions, XAI can help developers to understand and optimize the models, which can improve the overall quality of the software. Additionally, XAI can be used to provide interpretability and transparency in the models, which can help to build trust and understanding of the models by non-technical stakeholders.

This blog has discussed XAI methodologies, it’s function in the banking sector, and how it may be used to improve bespoke software processes.

.jpg)

No comments:

Post a Comment